“Planning effectively for the transition to a net zero emissions world is an essential strategy for business survival”, says Julie Baddeley, Co-Chair of the Transition Plan Taskforce Sector Guidance Workstream.

Julie is also the Chair of Chapter Zero Alliance.

The global economy has been built around a relatively stable climate. Now, however, assets, supply chains and business models are under increasing threat from physical risks such as droughts, wildfires and floods, and businesses need to understand the financial implications.

Mandatory disclosure requirements are already in place in many countries or likely to occur within the strategic planning horizon of many companies. These regulations urge businesses to disclose not only the financial impact of climate change, but also the approach they are taking to manage and mitigate this impact. Voluntary disclosure of climate and sustainability information is also increasingly prevalent for proactive organisations wishing to share detailed information with stakeholders.

The recent pushback on climate action in the US and some other western economies is delaying the inevitable, and the longer it lasts, the more extreme the risks will be. Companies need to consider taking action as an investment, not a cost: the capital required now will be significantly less than if forced by regulation as physical risks worsen over time.

Successful leaders use a long-term as well as short-term lens

The smart, far-sighted companies are planning now, testing their strategies against a range of climate scenarios and ensuring that they are prepared for the risks. They are also, just as importantly, considering and grasping the opportunities of the transition.

Leading businesses have been at this for some time. They have well-developed transition plans which have been published and refined in the last few years. Some put plans in place more than a decade ago and have since been adapting them as events evolve.

Proof of businesses’ increased engagement is no better illustrated than through the Science Based Targets initiative (SBTi) 2025 Trend Tracker. In August this year, the tracker revealed that companies representing more than 40% of global market capitalisation have set science-based targets. This critical mass now covers more than a quarter of global revenue. These companies are already reaping the rewards through more robust business models, new products, increased competitiveness and cheaper financing. In short, they are riding the wave and leaving others in their wake.

Transition plans: the heartbeat of a resilient future

Climate action must be central to business strategy. A good transition plan is not separate from the wider corporate strategy: it is fully embedded into the overall plans of a business, at its heart, keeping the company alive and thriving.

Good transition plans enable companies to make smart decisions on investment, to take advantage of opportunities, to avoid impairment of assets, and to make sure they build the skills they need for the future. For boards, a good transition plan enables them to enhance oversight, strengthen risk management and ensure long-term resilience.

Climate change and nature loss will inevitably disrupt financial markets to a degree that has not yet been felt in our lifetimes.

“As company directors, we cannot prevent many of these changes within the context in which we operate, but we can prepare and manage the risks as we would any other risk to our business. We must ensure that we understand the opportunities available to us that deliver business resilience and give us a chance of getting back to safe levels of greenhouse gases in our atmosphere.”

Outsmart tomorrow’s risks today

Responding effectively to our changing climate is not optional. The changes are here and accelerating even faster than was predicted by many experts.

Whatever the politics at play, market forces are starting to react to the changes: hedge funds are taking short positions on fossil fuels, insurance premiums are rising with many risks becoming uninsurable, and renewable energy is becoming a significantly cheaper source of power generation than fossil fuels, to name but a few indicators. And this is happening at a time when regulation has not forged ahead at the pace needed to avoid the worst of the climate tipping points. It is largely market-led, not policy-led.

Transition planning will be critical to developing a competitive business model and those who are not on board with the transition will be left behind. It forces us to ask the difficult questions:

- What are our vulnerabilities to the physical, regulatory and other transition risks?

- What assumptions are we making in our plans for the next three to five years and next year’s budget?

- What are our competitors doing about climate risk and opportunity?

- What do our employees think?

- What about our customers?

Explore useful tools & resources

Strategic planning is core to the work of any board. But for many, considering and embedding climate and nature impacts remains relatively new. There are lots of materials and guides to help, including:

Transition Planning Framework resources developed by the Transition Plan Taskforce and hosted by the ISSB/IFRS Foundation. This guidance helps boards think through the implications for their businesses which will depend on their scale, sector, the geographies in which they work and the customers they support.

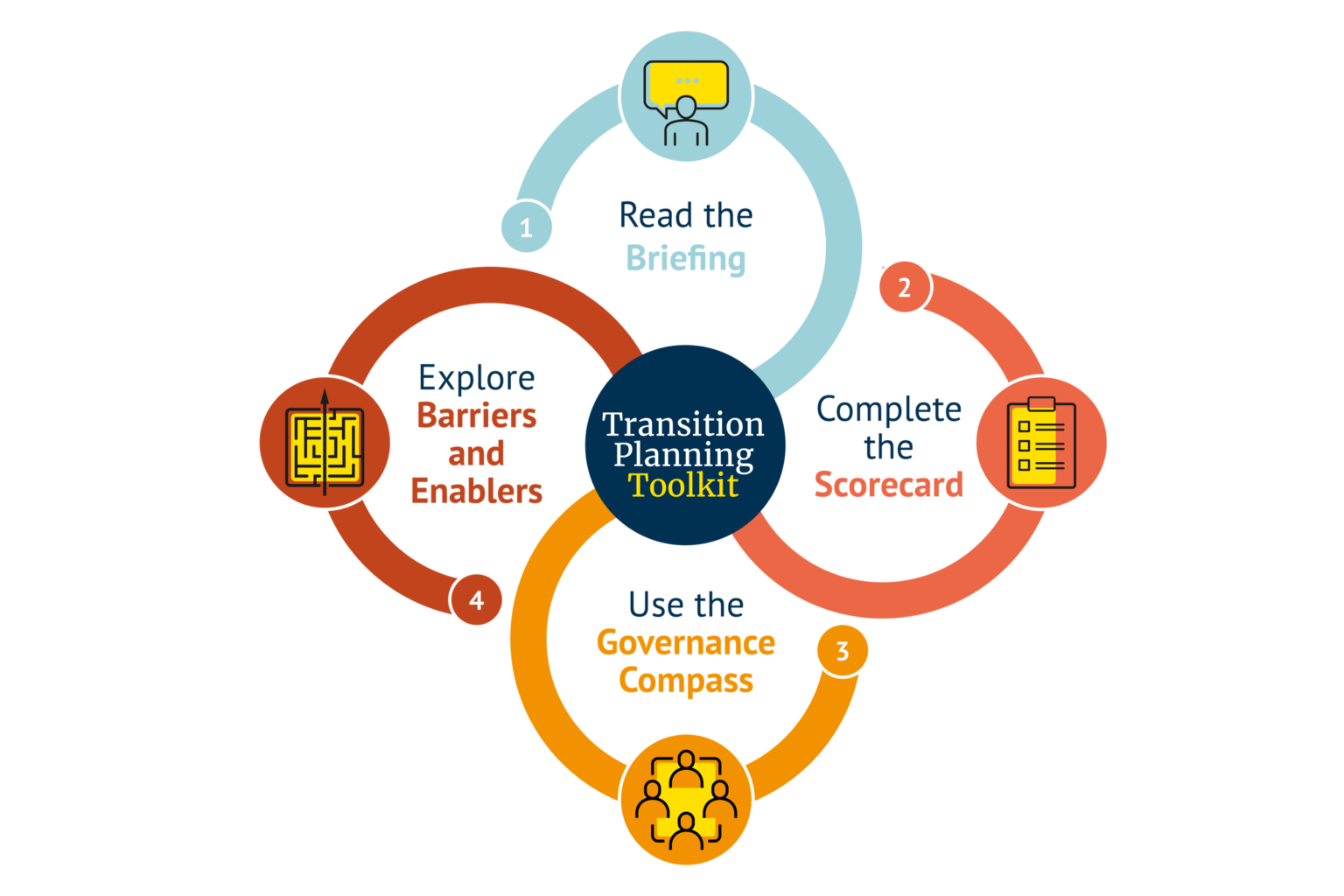

Transition Planning Toolkit by Chapter Zero, the UK Chapter of the Climate Governance Initiative, which has published its own guide to transition planning with board assessments to understand how effectively it is being handled.

Using these tools today will go a long way to future-proofing your business and making sure it survives and thrives in the changing world we will be operating in for the next decade and beyond.

COP30 Action Agenda for Business

With COP30 bringing together global leaders for the next round of UN climate negotiations in Brazil, and the world’s Nationally Defined Contributions (NDCs) not at the level needed to lower global emissions towards safe levels of warming, much of the focus will be on the ‘Action Agenda’ for businesses, civil society and local governments. There will be a collective global effort to connect investment, innovation, finance, technology and capacity-building opportunities for climate action, and a push to scale up climate finance flows through the Baku-to-Belém Roadmap.

The climate is changing, and far faster than many scientists expected. Our businesses and economies are at risk if we do not adapt and bring emissions under control now. Effective transition planning will be integral to delivering the global action agenda. If all companies have in place robust transition plans based on rigorous debate and data, we can respond to this challenge and may be able to protect the asset values on which we all depend.