This explainer provides an overview of the evolving and interconnected landscape of climate targets, metrics, reporting standards and frameworks for independent directors and non-executive directors (NEDs). There are a range of frameworks and standards supporting corporate disclosure of climate, sustainability and ESG information.

This explainer is supported by an interactive tool to help you understand and identify the initiatives most relevant to the company boards you sit on. |

Why is climate disclosure important for board directors?

Ensuring transparent disclosure of climate risk and opportunity, so that investors and other external stakeholders are provided with relevant information to make decisions, is integral to the role of board directors. This explainer provides an overview of the evolving and interconnected landscape of reporting standards and frameworks, carbon footprint measurement and climate target setting. There are a range of tools available to support companies at all steps of the journey. This summary, alongside our interactive navigation tool, will help you understand and identify the initiatives most relevant to the company boards you sit on.

Key takeaways for board directors

As a board director, it is important to understand the tools and standards being used by the organisations you represent to measure climate impact, set and monitor targets, continually improve performance and report to stakeholders. The key takeaways from this explainer can be summarised as follows:

- The board plays an important role in ensuring all statutory reporting and disclosure obligations are met, and in pushing for best practice on voluntary reporting. Board directors should ensure that appropriate governance structures are in place to deliver on net-zero commitments, including selection of scientifically robust disclosure tools, and effective oversight and implementation across carbon accounting and reporting. The disclosure and reporting requirements for your company will depend on the jurisdiction(s) it operates in, and an outline of mandatory disclosure requirements is included below.

- The board should be confident that the company is making good progress against its climate goals, particularly when compared with other companies. This is something investors will consider in decision making – the World Benchmarking Alliance assesses corporate sustainability performance in key industry sectors.

- Being well-informed of future trends is important for strategic planning and decision making in the boardroom. The global harmonisation of sustainability standards is already underway, with the International Sustainability Standards Board (ISSB) releasing its two inaugural standards in June 2023. Going forward, there will be a growing demand for standardised, high quality transition plans that show how companies will meet net-zero targets. Consider ways that you can share and exchange your organisation’s experiences through coalitions and direct engagement, not only to accelerate the net zero transition, but also to create a level playing field and build industry excellence.

To build your climate expertise as a board director, contact your local Chapter of the Climate Governance Initiative.

Questions to ask in the boardroom

Measuring emissions

- Does the company measure its full carbon footprint across Scope 1, 2 and 3 using the GHG Protocol methodology?

- Is there a strategy to improve carbon reporting data and coverage where gaps currently exist?

Setting targets

- Has the company set science-based targets, both long-term and in the interim?

- What plans does the company have to meet these targets and measure progress against them?

- Does the company have a credible net zero transition plan?

- Is the company using a reputable industry standard to validate its net zero programme?

- Is the company ready to take part in a coalition activity that will bring more public visibility to its targets?

- How is the company performing on executing its plans and targets compared to others in the sector?

Reporting and disclosure

- Is the company meeting its statutory obligations in relation to the reporting and disclosure of climate risks and opportunities?

- If there is no statutory obligation, does the company understand which of the voluntary frameworks is best suited for this purpose, and is it using it?

- Has the company thought strategically about whether it will report and disclose climate information in the context of the wider sustainability agenda? What is the rationale for its decision?

- Is the company tracking future trends in climate disclosure – what is on the horizon?

Reporting and disclosure requirements

ASEAN – a number of countries in the ASEAN region have reporting and disclosure requirements in place for publicly listed companies, including Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam. Some of these are mandatory; others are on a ‘comply or explain’ basis. Further detail for each jurisdiction in the ASEAN can be found in a 2022 report by the Global Reporting Initiative (GRI).

Chile – Regulations by the Financial Markets Commission require entities to disclose in annual reports (i) ESG information based on, for example, the work of the Sustainability Accounting Standards Board and the Global Reporting Initiative; (ii) material climate-related risks inclusive of the TCFD’s recommended risks; and (iii) sector-specific SASB sustainability information or provide an explanation for why they have not done so.

China – China’s Ministry of Ecology and Environment (MEE) requires some listed companies, specifically those with a high environment impact, to disclose on a range of environmental information.

Egypt – Under regulations issued by the Financial Regulatory Authority, ESG issues must be disclosed in the annual reports of financial institutions (excluding banks) and listed companies. Specific climate financial information relating to, for example, risk management and targets, will have to be disclosed if the entity’s total equity or capital is greater than 500m Egyptian pounds.

European Union – In the EU, the Non-Financial Reporting Directive (NFRD) requires all listed companies to disclose a company’s short-term, medium-term and long-term risks of science-based climate change scenarios on corporate strategies and activities. The NFRD is being replaced by the Corporate Sustainability Reporting Directive (CSRD), which is coming into force in stages from 1 January 2024. When fully in force, the CSRD will require all companies to disclose the resilience of their business model and strategy to sustainability-related factors; plans to align the business model and strategy with the transition to a sustainable economy, defined as limiting the rise in global average temperature to 1.5°C above pre-industrial levels, in line with the Paris Agreement; and sustainability-related targets, including absolute greenhouse gas reduction targets for at least 2030 and 2050, supported by a statement on whether such targets are based on conclusive scientific evidence, amongst other things. Disclosure under the CSRD must adhere to EU Sustainability Reporting Standards, which are being prepared by the European Financial Reporting Advisory Group (EFRAG).

Additionally, the Sustainable Finance Disclosure Regulation (SFDR) imposed mandatory ESG disclosure obligations for asset managers and other financial markets participants from March 2021, with additional entity and product level disclosures required from January 2022.

Hong Kong – the Hong Kong Stock Exchange (HKEX) requires ESG reporting for listed companies, with both mandatory disclosure requirements and ‘comply or explain’ provisions.

India – the top 1,000 companies by market capitalisation must disclose an overview of their material business conduct and sustainability issues, including risks arising from climate change, under SEBI regulations.

New Zealand – large publicly listed companies, insurers, banks, non-bank deposit takers and investment managers are required to make climate-related disclosures. Further detail can be found on New Zealand’s Ministry for the Environment.

UK – it is mandatory for the largest listed businesses to disclose climate-related risks and opportunities in line with TCFD recommendations. For more detail on the requirements in the UK, please see Chapter Zero’s explainer, and guidance on the UK Government’s page.

Incoming regulation

The US Securities and Exchange Commission (SEC), the Canadian Securities Administrators (CSA) and Japan’s Financial Services Agency (FSA) are all preparing for similar mandatory approaches in line with the 2021 announcement from G7 finance ministers to mandate climate-related financial reporting based on TCFD recommendations.

The Swiss Federal Council has finalised regulations requiring mandatory climate disclosures from large companies as of 1 January 2024.

The Central Bank of Brazil (BCB) has announced plans to mandate climate reporting in the next couple of years.

Context

Understanding the organisation's carbon footprint and setting targets

- To set meaningful climate targets, and to provide insight into where action and resources should be focused on making reductions, it is important to understand the organisation’s baseline emissions by measuring across the whole value chain (read Chapter Zero’s scope explainer to understand scope 1, 2 and 3 emissions).

- The GHG Protocol provides a universally accepted approach for organisations to calculate their GHG emissions profile, also referred to as their carbon footprint.

- The setting of robust climate targets, and implementing a plan to track progress and meet them, are an essential part of a business’s decarbonisation strategy and climate-related disclosure.

- Targets should align with the international scientific consensus, which states that to meet the goals of the Paris Climate Agreement, net-zero carbon dioxide (CO2) emissions must be reached by 2050, with 50% of emissions reductions needed by 2030.

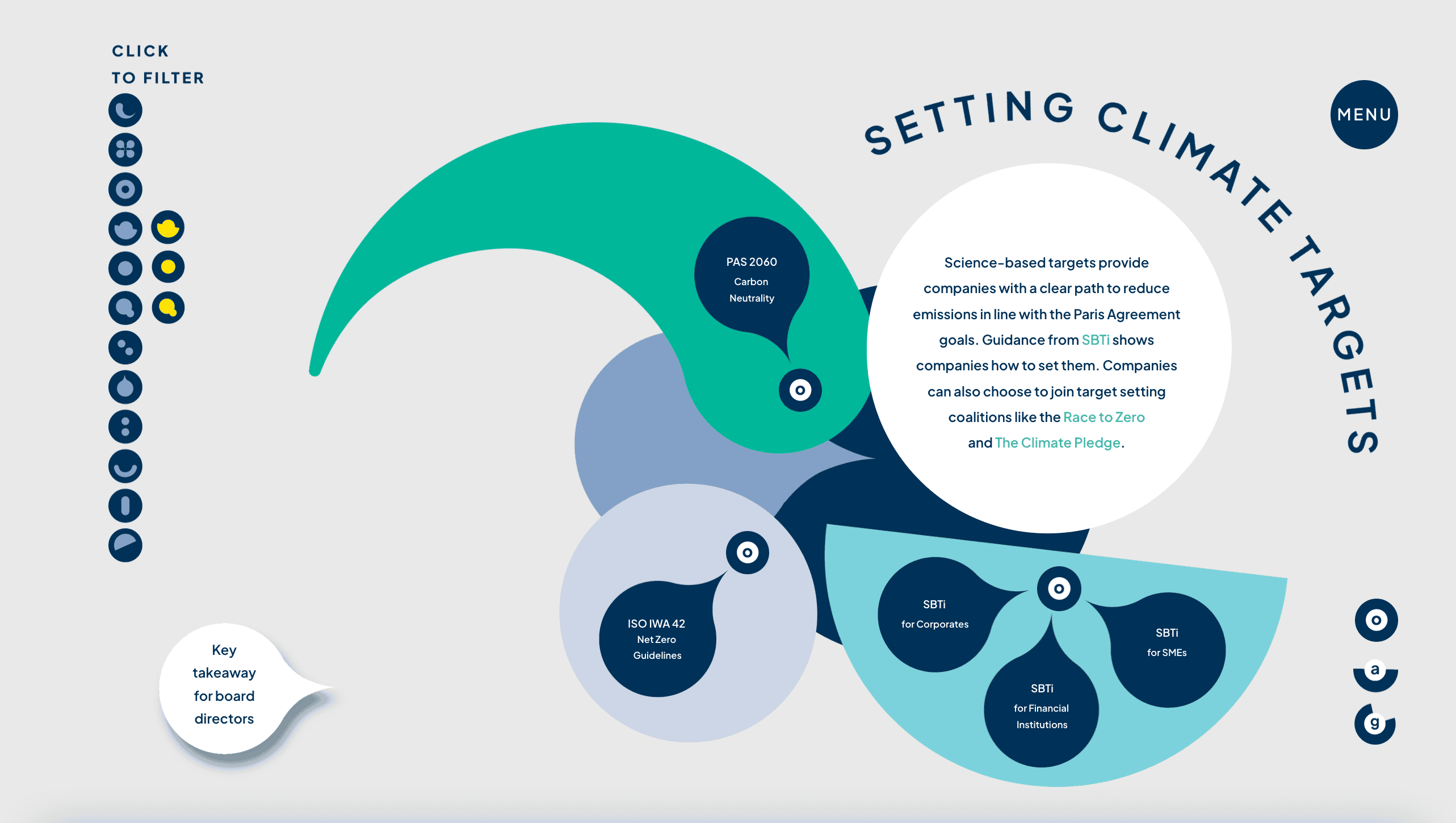

- Companies should follow a recognised standard to support their net-zero programmes, in order to protect against reputational risk. A number of initiatives exist to support companies on the road to net zero.

- Your company can set both near-term targets and long-term net zero targets adhering to the Science Based Target Initiative’s (SBTi’s) Net Zero Standard

- The recently launched ISO Net Zero Guidelines underpin this framework, by providing a foundation for achieving net zero GHG emissions for organisations at every level. The UN report 'Integrity Matters: Net zero commitments by non-state entities’ also provides relevant recommendations for companies.

- Going forward, there is likely to be an increased focus on credible transition plans to support net-zero targets, showing in detail how the targets will be met. Developing a robust and measurable climate action plan which tracks progress against the company’s targets and is aligned with capital allocation plans, is crucial for all companies.

- Net-zero targets should be public and disclosed. The company may want to join a coalition of climate leaders setting net-zero targets, like the Race to Zero, for peer-to-peer support. Some coalitions, like the 1.5°C Business Playbook, involve pledging to reduce emissions across the entire value chain of the company.

- At a solution-based level, RE100, EV100 and EP100 provide a platform for businesses to set and achieve ambitious commitments in relation to zero carbon electricity grids, electric vehicles and energy efficiency that will help deliver against a net-zero goal.

- For further information on the range of methodologies to support companies in setting climate targets visit our Navigating the Climate Disclosure Landscape interactive tool.

Understanding the organisation’s disclosure and reporting requirements

- The disclosure and reporting requirements for your company will depend on the jurisdiction(s) it operates in. Several countries now mandate climate-related reporting and disclosures, and while many encourage voluntary disclosure, there is an increasing trend towards making this compulsory. See the information above for the jurisdictions mandating reporting and disclosure.

- Global harmonisation of sustainability disclosure standards is underway. In November 2021, the IFRS Foundation launched the International Sustainability Standards Board (ISSB) to develop a global baseline of sustainability disclosure standards to meet investor needs, building on existing frameworks like the Task Force on Climate-Related Financial Disclosures (TCFD) and Sustainability Accounting Standards Board (SASB) Standards.

- The ISSB’s inaugural standards, IFRS S1 – on general requirements for the disclosure of sustainability-related information, and IFRS S2 – on climate-related disclosures, were launched on 26 June 2023. Together they are intended to form a global baseline of sustainability-related disclosures, ensuring that companies provide sustainability-related information alongside financial statements in the same reporting package.

- Other well recognised voluntary reporting initiatives are working with the ISSB to make sure that the landscape is as streamlined as possible. The Global Reporting Initiative, for example, which promotes a broad, cross-stakeholder ‘impact’ angle for corporate reporting, has an ongoing MoU with the ISSB.

- In general, climate disclosures should be considered within a broader sustainability or ESG context – creating long-term sustainable value, while driving positive outcomes for business, the economy, society and the planet. This is reflected in the broad majority of the reporting frameworks available to companies, and also the tools used by investors to assess company performance. For example, the World Benchmarking Alliance ranks and benchmarks 2,000 of the world’s most influential companies on their contributions to the Sustainable Development Goals.

- Looking ahead, board directors should note the upcoming launch of the Taskforce on Nature-related Financial Disclosures (TNFD), a risk management and disclosure framework for organisations to report and act on evolving nature-related risks.

- The climate disclosure landscape is also seeing a shift towards transition plans, that show in detail how companies propose to meet Net Zero targets. The ISSB is preparing guidance on transition plan disclosures, and in the UK, the Transition Plan Taskforce will build on that baseline.

- For further information on the range of methodologies to support companies in setting climate targets visit our Navigating the Climate Disclosure Landscape interactive tool.

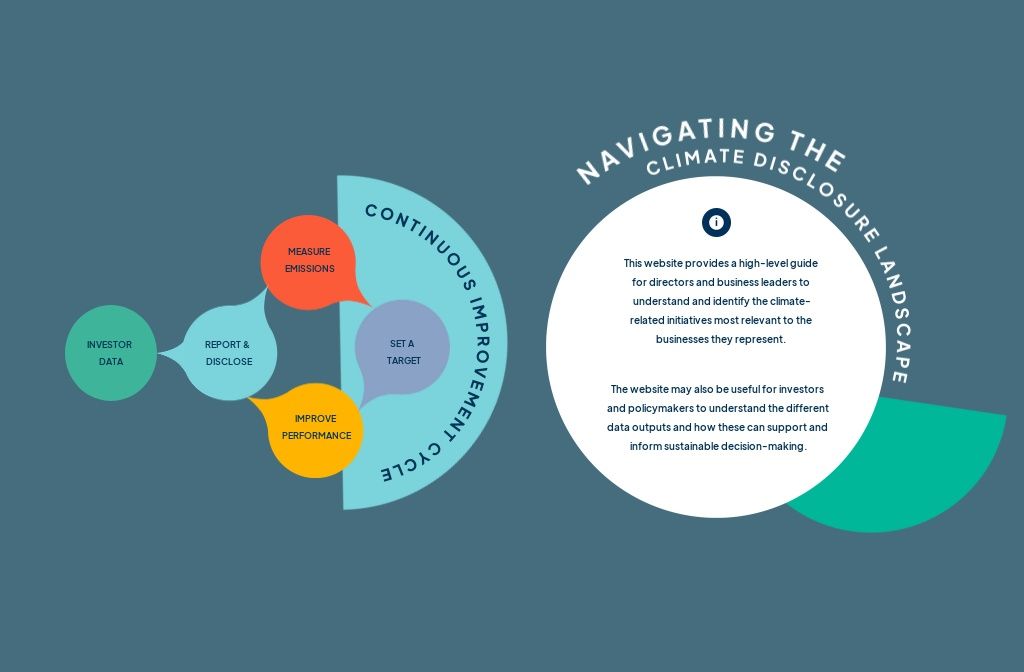

Tools for navigating the climate disclosure landscape

The Centre for Climate Engagement (CCE) has developed a simple tool for ‘Navigating the Climate Disclosure Landscape’. This tool provides basic information about the different frameworks and standards that companies can use to support carbon footprint measurement, target setting, improving performance and reporting and disclosure.