- Increasing global attention on sustainability reporting, and awareness of its importance for transparency and credibility of corporate activities may result in the adoption of TNFD reporting as a mandatory requirement by some jurisdictions in the coming years, as we have seen with the Task Force for Climate-related Financial Disclosures (TCFD) framework.

- The TNFD framework has a planned publication date of September 2023. The Climate Governance Initiative submitted a response to the consultation which may be of interest to board directors.

As stewards of their organisations, board directors will benefit from understanding the Taskforce on Nature-related Financial Disclosures (TNFD) framework ahead of its official launch in September 2023, and its implications for the organisations they represent. This briefing provides guidance to board directors on how to prepare for the incoming framework.

The corporate sustainability disclosure landscape is evolving to address key areas that are financially material to businesses and relevant to their just, net-zero transition. The Taskforce on Nature-related Financial Disclosures (TNFD) is working to provide guidance for companies to disclose their interactions with nature, recognising the important risks and opportunities that need to be taken into account.

Key takeaways for board directors

- Nature may present material risks and opportunities to businesses which will need to be accounted for. The Taskforce on Nature-related Financial Disclosures (TNFD) is working to provide guidance for companies to disclose their interactions with nature.

- Boards may want to consider and adopt the new TNFD framework and guide their organisations to disclose nature-related risks, impacts and dependencies ahead of an adjusting financial and regulatory landscape and increasing stakeholder expectations.

- Increasing global attention on sustainability reporting, and awareness of its importance for transparency and credibility of corporate activities may result in the adoption of TNFD reporting as a mandatory requirement by some jurisdictions in the coming years, as we have seen with the Task Force for Climate-related Financial Disclosures (TCFD) framework.

- The TNFD framework has a planned publication date of September 2023. The Climate Governance Initiative submitted a response to the consultation which may be of interest to board directors.

Context

The Taskforce on Nature-related Financial Disclosures (TNFD) framework is a practical tool that supports the adoption of the Global Biodiversity Framework (GBF), which saw its completion at the Convention on Biological Diversity’s 15th Conference of the Parties (COP15) in December 2022. The final TNFD framework is expected in September 2023. TNFD Taskforce Members include global financial services and corporates, with Council members and Consultation Groups from international governments, think tanks and NGOs.

In light of this coordinated industry and policy approach, board directors and corporate boards may want to consider and adopt the new TNFD framework and guide their organisations to disclose nature-related risks, impacts and dependencies ahead of an adjusting financial and regulatory landscape and increasing stakeholder expectations.

Why is nature relevant to business?

Nature may present a material risk and opportunity to the business which will need to be accounted for in corporate decision-making. Organisations depend on environmental assets and ecosystem services to produce goods and services. At the same time, business activities can have significant impacts on nature; for example, water pollution (negative) or habitat creation (positive).

The TNFD aims to help organisations better understand and manage nature-related risks through tools such as heatmaps1, asset tagging2, and scenario-based risk assessment3. The TNFD also provides recommendations for consistent and comparable nature-related financial disclosures.

Get ahead of the game: prepare for engagement with the TNFD framework

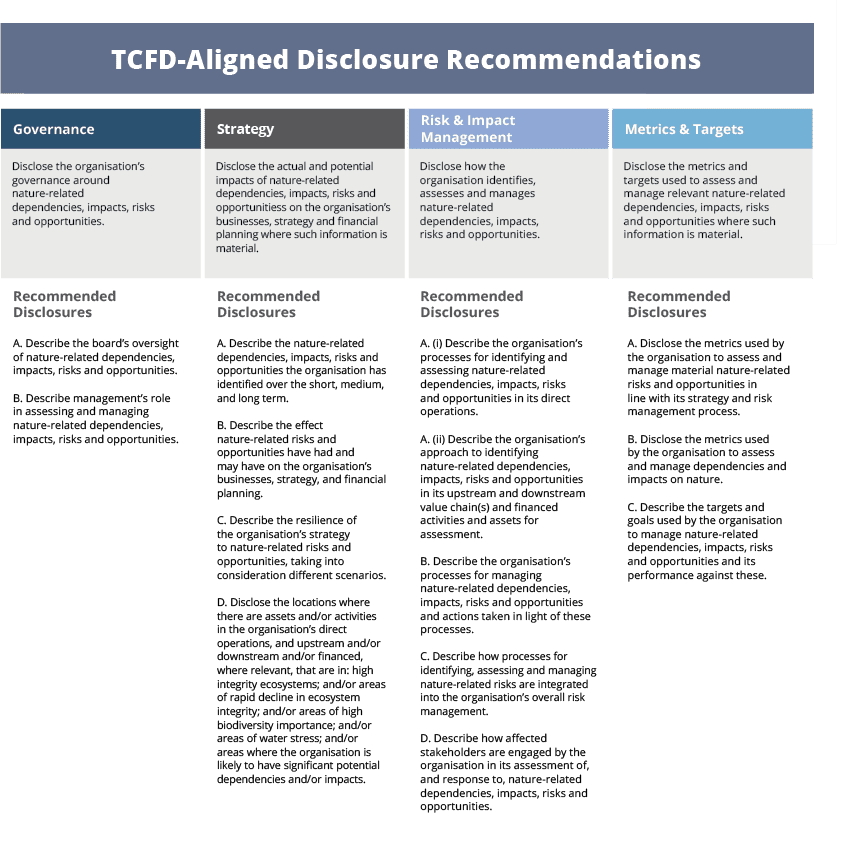

By promoting transparency and accountability in corporate reporting, the TNFD may assist boards in understanding the risks and opportunities of nature-related issues associated with their organisation. The TNFD framework provides a useful overview for boards to consider:

Figure 1. TNFD Nature-related Disclosure Recommendations v0.4 (TNFD Secretariat, 2023). This work is licensed under a Creative Commons Attribution 4.0 International License.

Towards mandatory disclosure: TCFD and TNFD

TNFD disclosure recommendations have been modelled on the Task Force on Climate-related Financial Disclosures (TCFD). TNFD is distinguished by a double materiality approach – accounting for the financial risk to the business as a result of nature-based issues, as well as the impact the business has on nature. In this context, nature means all aspects of the environment including the atmosphere, land, freshwater and the ocean.

The TCFD framework is increasingly being incorporated into law. Some countries have made it mandatory such as New Zealand, the UK, Hong Kong, Switzerland and the EU, amongst others, with several more jurisdictions announcing their intention to do so. It is expected that TNFD may follow a similar regulatory pathway. For instance, the UK has announced that by the end of 2023, it will be discussing how TNFD should be incorporated into national policy.

Learn more

For a deep-dive into nature-related topics and the corporate disclosure landscape, have a look through the following reports: