This briefing, produced by the Commonwealth Climate and Law Initiative (CCLI) and the Climate Governance Initiative, provides guidance on new, existing and proposed legislation on value chain due diligence, company obligations, and driving due diligence across value chains.

Key points on value chain due diligence

- New legislation and existing guidance require and encourage companies to carry out due diligence over their value chains to identify and mitigate human rights, and in most cases, environmental issues.

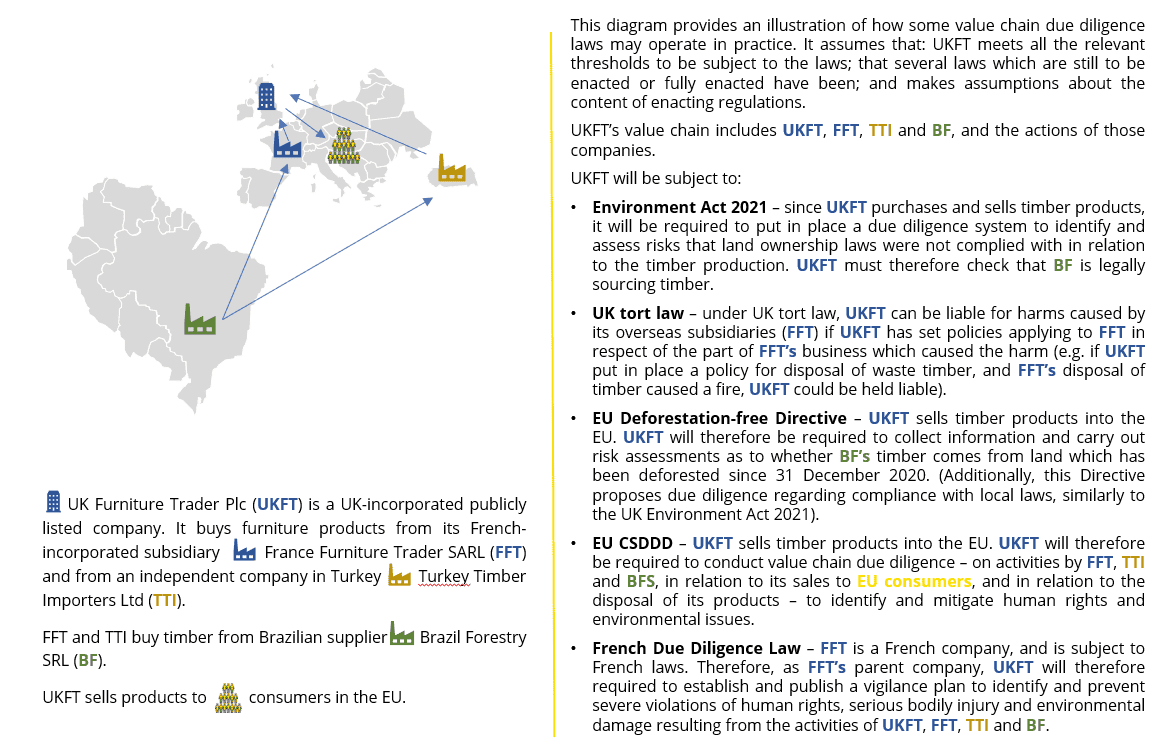

- A ‘value chain’ is a broad concept. While the definition varies between legislation, it can encompass the company itself, its subsidiaries and direct and indirect suppliers, and the actions and processes used by these entities to bring a product to the end consumer and dispose of it.

- Most existing and proposed due diligence laws do not relate directly to climate change impacts, but relate to climate-adjacent issues such as deforestation, environmental damage and human rights.

- The proposed EU Corporate Sustainability Due Diligence Directive goes further, requiring in-scope companies to ensure that their business model and strategy are compatible with the transition to a sustainable economy and the limiting of global warming to 1.5°C in line with the Paris Agreement.

- UK courts have signalled that they may take a broad approach to parent company liability, which may be persuasive in other common law jurisdictions, and have implications for multinationals with UK-incorporated parents.

- Companies disclosing Scope 3 emissions targets should consider what measures they can take to ensure these may be encouraged or enforced throughout their value chains.

What is a value chain?

The definition of a company’s ‘value chain’ or ‘supply chain’ differs between relevant laws. Generally, it includes the activities used to produce the company’s products or services and provide them to its customers; in some cases, it includes the disposal of the product as well. It is not limited to the activities by the company itself, but includes activities of other companies which are “established business relations”.

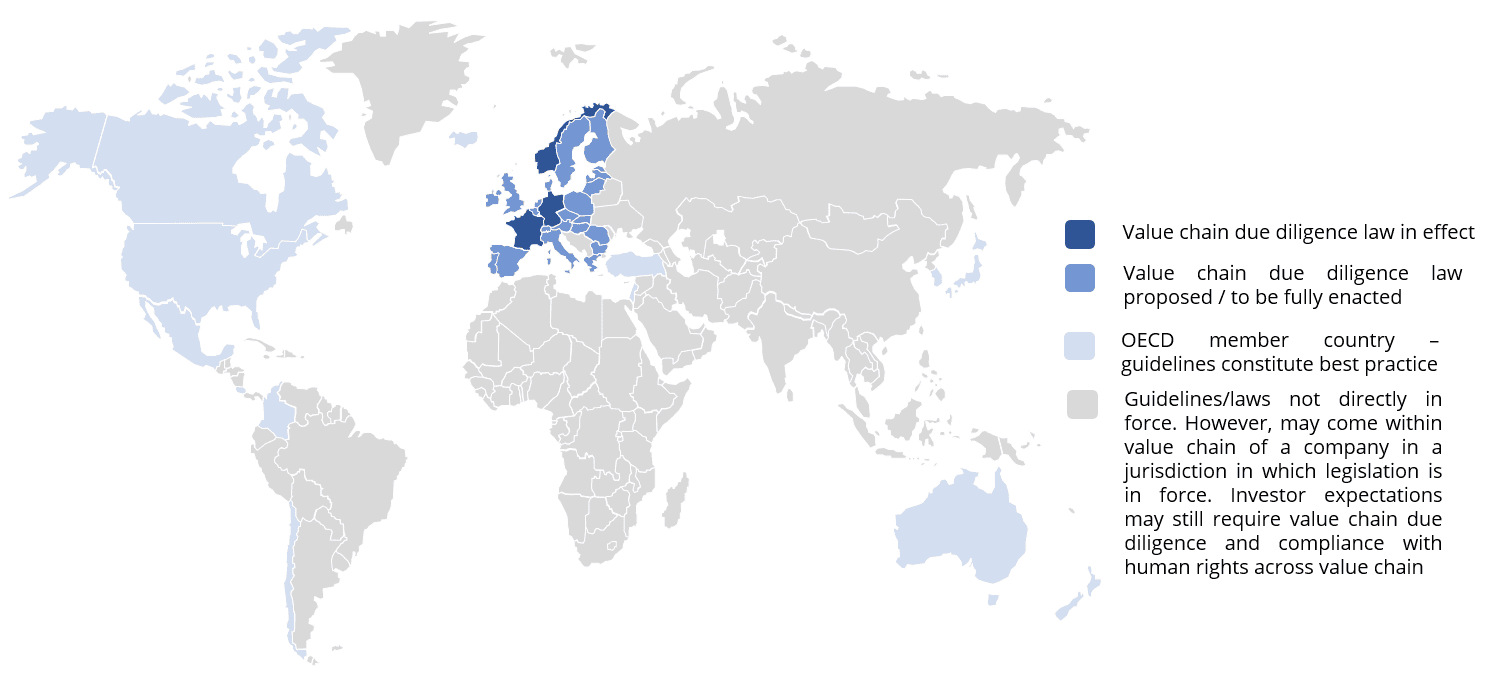

A company’s value chain can therefore encompass the actions of the company itself, its subsidiaries and its direct and indirect suppliers. A company’s value chain can extend over multiple jurisdictions and to entities outside its corporate group – therefore, while legislation and litigation to date in this area have focused on European companies, these are likely to have knock-on effects for companies globally.

Additionally, the legislation passed and proposed to date is designed to have effect on companies doing business in the jurisdiction in question (rather than just companies incorporated in that jurisdiction).

OECD Guidelines

The Organisation for Economic Co-operation and Development (OECD) has issued guidelines on responsible business conduct, which cover due diligence on a company’s ‘business partners’ (a broad definition of ‘value chain’). The OECD has also issued specific guidelines on due diligence. Multinational companies are encouraged to identify, assess and mitigate actual and potential adverse impacts associated with their operations, products or services, disclose how those impacts are dealt with, and provide for remediation where appropriate.

These guidelines are not legally binding, but constitute best practice for multinational organisations. Many of the existing value chain due diligence laws have been based on or require adherence to the OECD guidelines.

The OECD guidelines are subject to a dispute resolution process through National Contact Points (NCPs). These are non-judicial organisations which mediate disputes relating to a company’s adherence to the OECD guidelines. Complainants have used NCPs to bring non-judicial claims against companies in relation to climate impacts. For example, an NGO brought a complaint against three large Japanese financial entities financing Vietnamese coal power stations, alleging that required consultation had not been correctly carried out and that the projects’ emissions intensity was unacceptably high in comparison with international standards (Market Forces v. SMBC, MUFG and Mizuho).

On 13 September 2022, the Japanese Government published the Guidelines on Respecting Human Rights in Responsible Supply Chains. The Guidelines do not directly reference the environment or climate change, but cover all internationally-recognised human rights (which can encompass climate change impacts – see below). As with the OECD Guidelines, complaints are to be resolved through Japan's NCP.

Existing legislation

Several jurisdictions have laws in force requiring companies to conduct ESG due diligence on their value chains.

The laws in force to date do not explicitly require due diligence on climate risks and impacts, but focus on human rights breaches and environmental harms such as deforestation. Climate-related claims brought so far have been under the French ‘duty of vigilance’ law, which refers broadly to human rights and environmental damage. In contrast, the German law and the proposed EU Corporate Sustainability Due Diligence Directive (CSDDD) refer to specific international human rights and environmental treaties, generally those referring to labour rights and biodiversity loss.

However, given the impacts of climate change on human rights and the environment more broadly, companies should consider climate impacts as part of their value chain due diligence in order to avoid attracting litigation risk.

The UN Human Rights Council has identified the impacts of climate change on human rights related to food, health and vulnerable people, and will set up a panel discussion on different themes related to climate change and human rights in 2023; it is possible that these impacts could lead to climate-related impacts being brought within the scope of legislation focused on human rights.

Board members should be alert to the evolving legal requirements surrounding human rights and due diligence, and ensure they seek periodic advice from in-house and outside counsel regarding potential legislative changes, litigation and judicial precedents that could alter the effective standard of practice.

Proposed legislation

Several other laws relating to value chain due diligence have been proposed, or are pending enactment. These vary in scope, but generally incorporate climate impacts to a similar or greater extent.

Most notably, the EU Commission has proposed the CSDDD, which if enacted would introduce a duty for certain companies to conduct value chain due diligence to identify and mitigate human rights and environmental issues, as well as publicly communicate how they are fulfilling these obligations. Climate change issues are not explicitly within the scope of the proposed due diligence, but are incorporated into directors’ duties by other provisions in the CSDDD.

The directive, as proposed, would have direct impacts on directors’ duties, making directors of these companies responsible for putting in place and overseeing their companies’ due diligence policies and related actions. The CSDDD also clarifies the scope of directors’ duty to act in the best interest of their companies, stating that directors must take into account the consequences of their decisions for sustainability matters, including climate change and human rights, in the short, medium and long term. More information on directors’ duties and climate change is available in our global Primer on Climate Change: Directors’ Duties and Disclosure Obligations.

Member States are also required to ensure that companies covered by the proposed Directive shall adopt a plan to ensure that their business model and strategy are compatible with the transition to a sustainable economy and the limiting of global warming to 1.5°C in line with the Paris Agreement.

Value chain impacts

The laws, both as proposed and as currently in effect, have a number of extra-territorial effects, including:

- Application to companies which are not incorporated in the country, but which do business in that country. This means that a company incorporated outside the EU but which does business in the EU could be required to meet the requirements of the CSDDD.

- Requiring companies to conduct due diligence on companies in their value chain, which can extend beyond national borders. This applies to operations outside the jurisdictional reach of the legislation – for example, under the proposed CSDDD an EU company would have to conduct due diligence on operations of companies supplying to it around the globe.

This may lead to companies within the value chain of companies which are subject to these laws being required to respond to requests for information, or complete self-declaration forms regarding their compliance with legislation, and put in place their own systems to acquire and verify relevant information.

The proposed US Federal Supplier Climate Risks and Resilience Rule demonstrates a slightly different approach; rather than putting obligations on parent companies, it would require Federal contractors receiving more than US$50m in annual contracts to disclose their scope 1, 2 and some scope 3 emissions, as well as their climate risks and emissions reductions targets. This approach puts the onus on companies in the supply chains directly, but is likely to require similar types of information gathering and reporting to other supply chain due diligence legislation.

Other exposures to value chain actions

Parent company liability

Generally, companies are not liable for actions of their subsidiaries. However, there are some exceptions to this rule.

Firstly, parent companies can, in rare cases, be held liable for the actions of their subsidiaries when the subsidiary is acting on behalf of the parent company to the extent that it is not carrying on its own business; or where the subsidiary is only being used to protect the parent company from liability.

Secondly, in some jurisdictions, a parent company can be held liable for the actions of its subsidiaries if it controls, supervises or advises on the management of the subsidiaries’ operations so that it would be fair, just and reasonable to find that the parent company owes a duty of care to parties affected by its subsidiaries’ actions. Two recent UK Supreme Court cases (Okpabi v Shell and Vedanta v Lungowe) have emphasised this point.

Courts are also taking novel approaches to interpreting and addressing group-wide harms. For example, in the well-publicised case of Milieudefensie v Shell, against the Shell group parent company Royal Dutch Shell (RDS) the court found that as a result of the CO2 emissions of the Shell group (rather than RDS), certain Dutch citizens would suffer harm. As a result, the court ordered RDS to reduce the CO2 emissions of its group by 45% by the end of 2030, relative to 2019 levels. Board directors should ensure that management has put in place appropriate policies to minimise the risk of harm occurring to third parties due to the actions of their subsidiaries.

Scope 3 emissions disclosures

Scope 3 emissions are indirect greenhouse gas emissions that occur in a company’s value chain, including both upstream and downstream emissions.

Companies may increasingly be required to report on their scope 3 emissions. For example, the UK listing rules require in-scope companies to state whether they have complied with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), which in turn require reporting scope 3 emissions where material. The Swiss Financial Market Supervisory Authority also requires certain financial institutions to report in alignment with the TCFD recommendations. Further information on current and upcoming TCFD disclosures is available in the TCFD’s 2022 status update.

Similarly, the US Securities and Exchange Commission (SEC)’s current proposal for climate information reporting would require scope 3 emissions disclosures if material, or if they were the subject of an emissions reduction target by the company.

While measuring and disclosing scope 3 emissions is likely to require estimates, as recognised by the TCFD, companies are increasingly doing so, as well as setting targets relating to scope 3 emissions. Generally, companies are likely to be protected from litigation risk where their scope 3 emissions estimates are reasonable and supported.

Since scope 3 emissions are produced by entities in companies’ value chains, companies should consider how to improve information on their scope 3 emissions. Guidance by the World Economic Forum, Science Based Targets initiative (SBTi) and the Carbon Disclosure Project discusses how corporate buyers can influence change at the required scale and speed through value chain engagement. Companies may wish to support their scope 3 targets by utilising contractual mechanisms in their supply chains. Companies which have done so include UK bank NatWest and telecommunications company Vodafone.

Litigation risk

To date, litigation in relation to value chain due diligence legislation has been brought under the French due diligence law:

- A claim has been brought against energy company Total alleging that its mandatory report on risks (including human rights risks) since it did not consider climate change-related impacts on human rights (Notre Affaire à Tous v Total).

- A claim has also been brought against supermarket chain Casino regarding their alleged failure to report on human rights and environmental risks arising from deforestation in their value chain (Envol Vert v Casino).

- Most recently, three French NGOs have written to BNP Paribas threatening legal action, arguing that the ‘duty of vigilance’ requires identification and mitigation of climate-related risks arising from investment and financing, such as providing finance to fossil fuel companies.

This may indicate that similar claims could be brought under other value chain legislation. In addition, board members should be alert to the risk of litigation as a result of the actions of their subsidiaries, or as discussed in a previous update, the risk of litigation for misleading investors in relation to scope 3 emissions disclosures.

What should board members do?

In order to ensure that their company’s legal obligations are met, and reduce litigation risk, board members should:

- Enquire from in-house or external legal teams as to applicable value chain due diligence requirements for their entire business (including externally to the corporate group).

- Ensure that management has a system in place to identify environmental and human rights risks within the company’s value chain. Ensure that systems are put in place to mitigate such risks and impacts and ensure legal compliance, such as contractual controls.

- Consider measures to ensure that disclosures and other public statements made by the company which relate to issues within the company’s value chain are supported and reasonable.

- Ensure that group-wide policies about minimising the human rights or environmental impacts of business activities are free from errors which may lead to harm to third parties.

Important note

This Quarterly Update is provided to directors in the Climate Governance Initiative network for educational purposes only. This document is not, and is not intended to be, legal advice. The CCLI, its founders, and partner organisations make no representations and provide no warranties in relation to any aspect of this document, including regarding the advisability of investing in any particular company or investment fund or other vehicle. While we have obtained information believed to be reliable, we shall not be liable for any claims or losses of any nature in connection with information contained in this document, including but not limited to, lost profits or punitive or consequential damages. While efforts have been made to ensure that this document is accurate and free from errors and omissions, this document should not be, and is not intended to be, relied upon for any purposes and readers are advised to conduct their own research and analysis and obtain their own legal advice.

Annex I - Legislation in force

These annexes set out current and proposed, or not yet in force, value chain due diligence legislation relating to climate and sustainability issues. Companies should be aware that other legislation, not directly related to climate, may also require due diligence; such as the conflicts minerals regulations.

| France - Due Diligence Law (Law no. 2017-399 of March 27, 2017 relating to the duty of care of parent companies and ordering companies) | |

| Impact(s) in scope | Human rights, environmental harm, bodily harm |

| Due diligence requirement | Identify and mitigate risks in value chain Companies are required to establish and publish a plan to identify and prevent severe violations of human rights, serious bodily injury and environmental damage resulting from their own direct activities, including from the activities of the companies they control, as well as indirectly from the activities of the subcontractors and suppliers with which they have an established commercial relationship. |

| Application | French companies with > 5,000 employees (direct and indirect) International companies with > 10,000 employees (direct and indirect) From March 2017 |

| Germany - Act on Corporate Due Diligence Obligations in Supply Chains | |

| Impact(s) in scope | Human rights, environmental harm In-scope human rights impacts are focused on labour. Similarly, environmental harms relate to the production or unsafe disposal of hazardous wastes. However, the Act prohibits any unlawful taking of land, forest or waters, which may include illegal deforestation. It also prohibits causing air pollution which harms the health of a person; it is possible that, interpreted broadly, this could include greenhouse gas emissions. |

| Due diligence requirement | Identify and mitigate risks in supply chains Companies are required to establish a risk management system to identify and mitigate risks of impacts to human rights or the environment, designate a responsible person, set out preventative measures, take remedial action and implement due diligence obligations in respect of indirect suppliers. |

| Application | German and international companies with >3,000 employees in Germany (decreasing to >1,000 employees in Germany from 1 January 2024) From 1 January 2023 |

| Norway – Transparency Act 2022 | |

| Impact(s) in scope | Human rights (labour) The definition of ‘human rights’ in the act is defined by reference to a non-exhaustive list of international treaties; while those referenced explicitly, and the purpose of the Act, are focused on labour conditions, commentators have suggested that environmental and climate impacts may be included in later amendments to the Act. |

| Due diligence requirement | Identify and mitigate risks in supply chain Companies are required to carry out due diligence in accordance with OECD Guidelines; this includes identifying and assessing actual and potential adverse impacts on in-scope human rights and decent working conditions, and taking measures to mitigate such impacts. |

| Application | Norwegian companies and international companies with >NOK70m in revenue; >NOK35m net assets; or >50 employees From 1 July 2022 |

Annex II - Proposed legislation

| Austria - Motion - Supply Chain Due Diligence | |

| Impact(s) in scope | Human rights, labour rights, environmental harm, climate impacts The motion refers to UN Guiding Principles on Business and Human Rights, the OECD Guidelines, and relevant environmental and climate standards (as yet undefined). |

| Due diligence requirement | Identify and mitigate risks in value chain It is proposed that in-scope companies: carry out due diligence at least annually; publish a progress report annually; conduct risk analysis; and conduct follow-up measures to stop and prevent adverse impacts in its entire global supply chain, own operations, subsidiaries, and subcontractors. |

| Application | Austrian and international companies doing business in Austria, which meet as yet unspecified criteria. |

| Belgium - Proposal on Duty of Vigilance | |

| Impact(s) in scope | Human rights, labour rights, environmental harm |

| Due diligence requirement | Identify and mitigate risks in value chain The duty of vigilance requires companies to provide mechanisms that allow, on an ongoing basis, identify, prevent, stop, minimize, and to remedy any potential and/or actual violation, human rights, labor rights and standards environmental issues throughout their supply chains, value; this obligation also applies to their subsidiaries. |

| Application | Belgian and international companies doing business in Belgium, which meet as yet unspecified criteria. |

| Finland – Proposed legislation on human rights due diligence (See government memorandum dated 12 April 2022) | |

| Impact(s) in scope | Human rights, environmental harm Proposed in-scope human rights impacts are focused on labour. Similarly, proposed environmental harms relate to the production or unsafe disposal of hazardous wastes. |

| Due diligence requirement | Identify and mitigate risks in value chain In-scope companies are proposed to be required to identify, prevent and mitigate adverse human rights and environmental impacts across their value chain. |

| Application | To be determined. |

| EU - Proposal for a regulation on deforestation-free products (adopted by EU Parliament) | |

| Impact(s) in scope | Focuses on certain commodities (cattle, cocoa, coffee, oil palm, soya and wood) and their supply chains. It is proposed that pigmeat, sheep and goats, poultry, maize and rubber, as well as charcoal and printed paper products are also included. It is proposed that these commodities are to be prohibited from being sold in the EU unless they are deforestation-free (i.e., they have not been produced using land which has been deforested since 31 December 2020, or, in the case of timber, has not led to forest degradation), and have been produced in compliance with local laws. |

| Due diligence requirement | Companies dealing with those commodities are required to collect information and carry out risk assessments regarding whether the relevant commodities meet those requirements. |

| Application | Companies dealing in specified commodities. |

| EU - Corporate Sustainability Due Diligence Directive (adopted by EU Parliament) | |

| Impact(s) in scope | Human rights, environmental harms These are defined by reference to a set of international conventions, and are broad in scope. |

| Due diligence requirement | Identify and mitigate risks in value chain In-scope companies must conduct value chain due diligence to identify and mitigate human rights and environmental issues, as well as publicly communicate how they are fulfilling these obligations. Companies are not required to identify and mitigate climate change issues within their supply chain under the scope of the proposed due diligence, but are required to adopt a plan to ensure that their business model and strategy are compatible with the transition to a sustainable economy and with the limiting of global warming to 1.5 °C in line with the Paris Agreement. |

| Application | EU companies, and international companies doing business in the EU, with over 500 employees and EUR150m turnover. International companies doing business in the EU, with over 250 employees and EUR40m. (Please note that the scope of the proposed Directive has been amended in the Parliament adoption, and may change prior to the Directive entering into force) |

| Netherlands - Bill on Responsible and Sustainable International Business Conduct to the Dutch House of Representatives | |

| Impact(s) in scope | Human rights, labour rights, environmental harm, climate impacts The motion refers to UN Guiding Principles on Business and Human Rights, the OECD Guidelines, and relevant environmental and climate standards (as yet undefined). |

| Due diligence requirement | Identify and mitigate risks in value chain The Bill proposes that in-scope companies must carry out due diligence in their value chain, and those that know or reasonably suspect that the activities of their supply chains may have adverse impacts on human rights or the environment must take actions to mitigate and prevent those impacts. Entities must also produce a plan to mitigate adverse climate impacts, including objectives of reducing greenhouse gas emissions by 55% by 2030. |

| Application | Dutch companies, and international companies doing business in the Netherlands, with over 250 employees and EUR40m turnover |

| UK - Environment Act 2021 (Schedule 17) (Note: The relevant provisions, including the list of in-scope commodities, require enactment through regulations, which as at December 2022, have not yet been passed.) | |

| Impact(s) in scope | Deforestation Organisations are prohibited from using ‘forest risk commodities’ which includes commodities produced by a plant, animal or other living organisms, which are not produced in accordance with local laws. |

| Due diligence requirement | Legal compliance in supply chain Organisations using these commodities will be required to put in place a supply chain due diligence system to identify information about that commodity, and assess and mitigate the risk that relevant local laws were not complied with in relation to that commodity. |

| Application | UK and international companies which meet as yet unspecified criteria. |