Global packaging leader Smurfit Kappa is dealing with increased demand for its products while also steering the business towards net zero by 2050. The FTSE 100 company was awarded five stars by Support the Goals in recognition of its support for the UN Sustainable Development Goals (SDGs) and was the first in its sector to set a net-zero target.

What is Smurfit Kappa?

Smurfit Kappa is a FTSE 100 company and one of the leading providers of paper-based packaging in the world, with operations in over 30 countries. Its headquarters are in Dublin, Ireland.

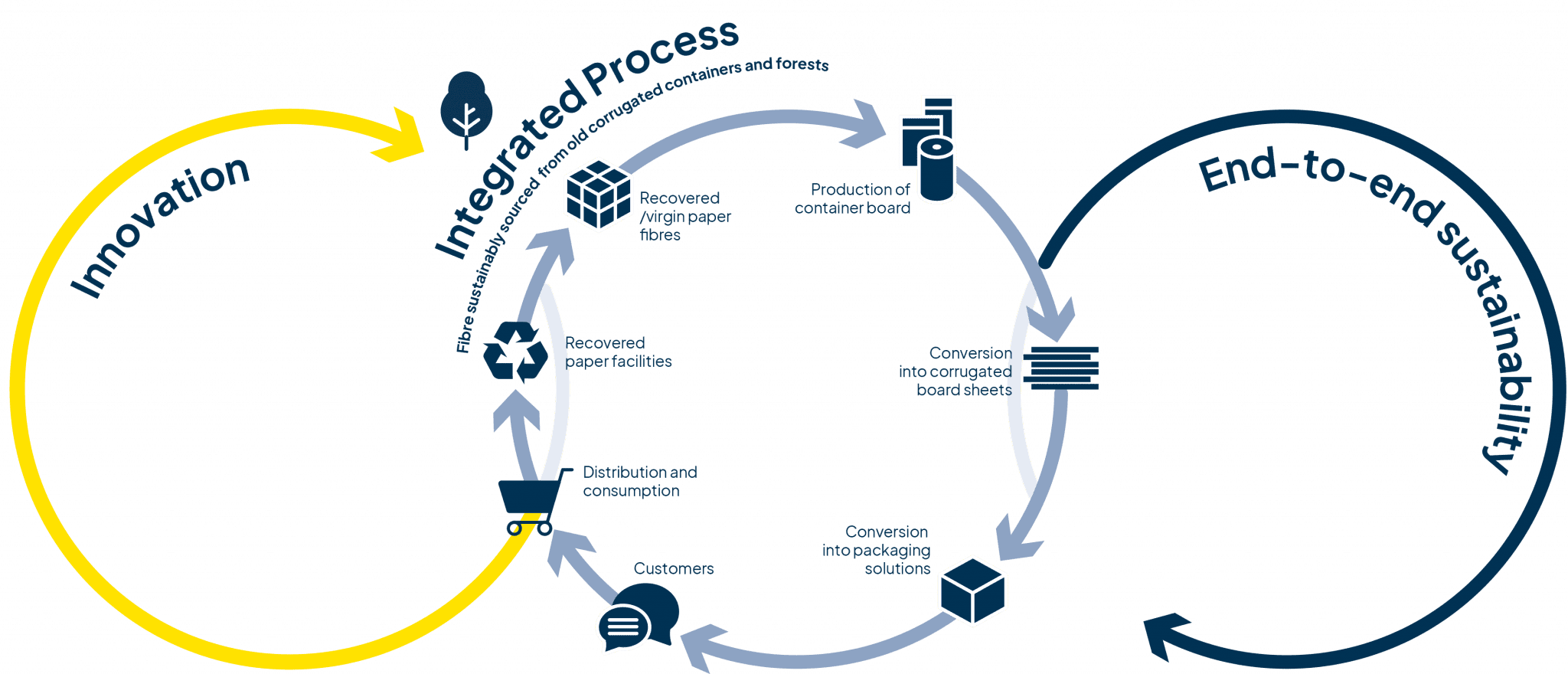

At the core of Smurfit Kappa’s approach is a circular business model, from the sustainable sourcing of its renewable and recyclable raw materials to responsible production of recyclable and biodegradable packaging solutions. Smurfit Kappa’s board plays an important role in the company’s climate and sustainability agenda, with four non-executive board members sitting on its Sustainability Committee.

Above: Smurfit Kappa’s Circular Business Model

The Challenge

Smurfit Kappa’s leadership, including its board, sees the organisation’s investment in sustainability not only as the right thing to do, but as a competitive advantage and something that customers, employees and investors want to see more of. The organisation wants to be an industry leader and has set some challenging targets including an aim to reduce scope 1 and 2 CO2 emissions per tonne of paper by 55% by 2030, with achievement to date at 43.9% (2022) reduction since 2005. In 2021, its target to reduce scope 1 and 2 emissions was validated by the Science Based Target initiative (SBTi) as being in line with the objectives of the Paris Agreement and well below 2 degrees Celsius.

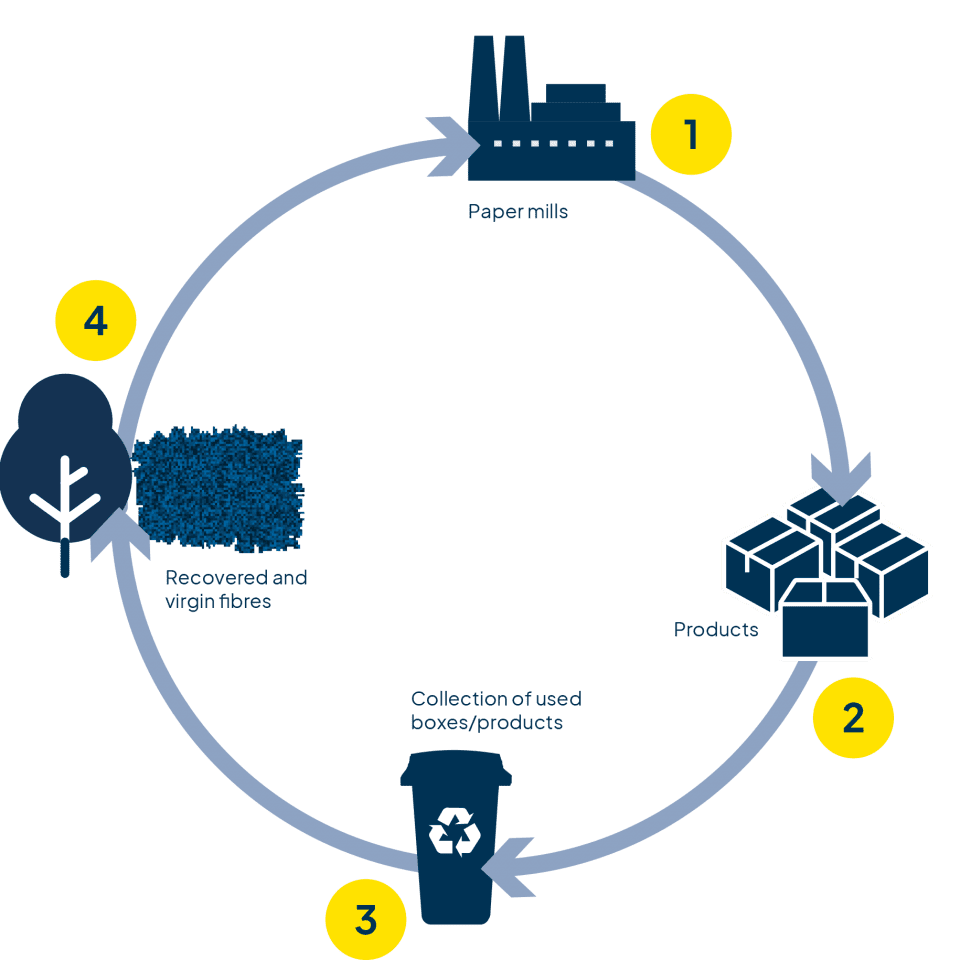

| 1 | 2 | 3 | 4 |

| 8 million tonnes of (primarily) post-consumer recovered paper handled each year | 100% renewable, recyclable and biodegradable | 100% used packaging reclaimed | 88% of the paper collected is recycled in Smurfit Kappa’s own mills |

Above: Smurfit Kappa’s Circular Business Model Alignment with EU Ambitions

Linking sustainability targets to corporate finance

Responding to the need to invest further in reducing carbon emissions and to meet its sustainability objectives, Smurfit Kappa developed an innovative green finance strategy.

In 2020, the organisation integrated its corporate sustainability strategy into its funding strategy by converting its €1.35 billion multi-bank Revolving Credit Facility (RCF) to a sustainability-linked loan. The margin on this RCF is linked to the achievement of five key performance indicators on Climate Change, Forest, Water, Waste and Health & Safety, with the achievement of all five targets required to attain maximum margin benefit. In 2021, this initiative was extended to its two securitisation programmes, which together raised a further €330 million.

Green bonds

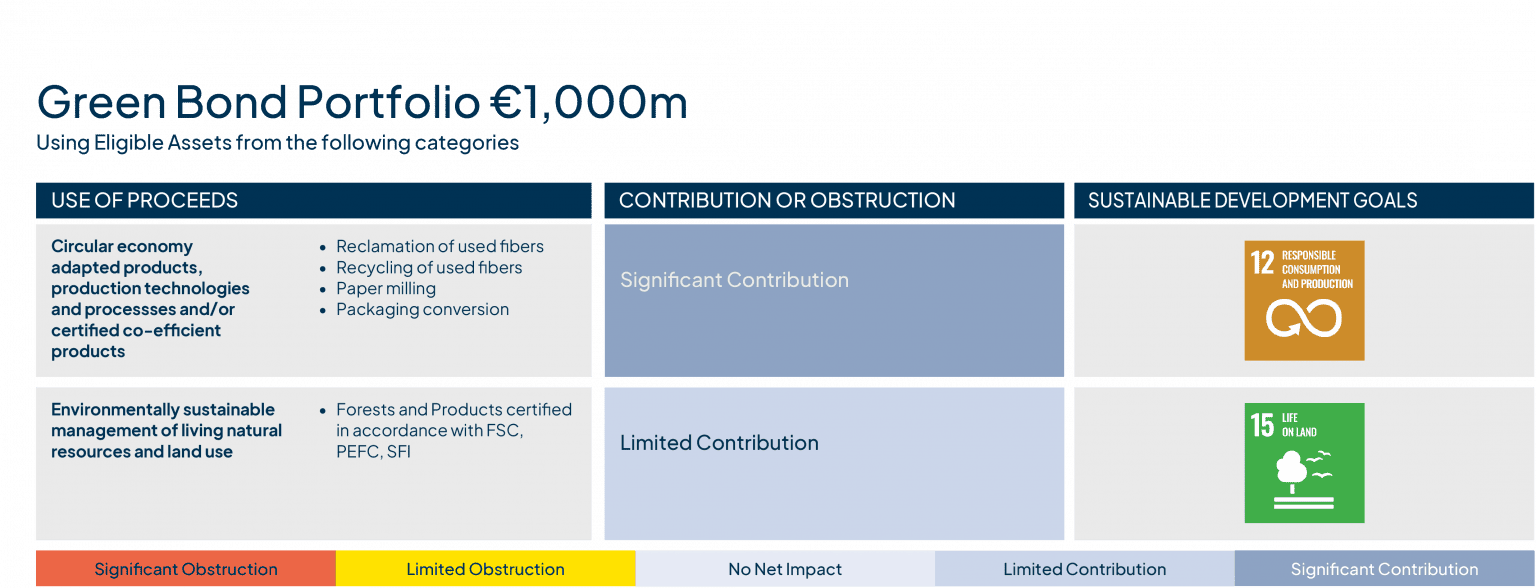

As part of the ongoing integration of sustainability ambitions into the funding strategy, the Smurfit Kappa Green Finance Framework was established in 2021, under which the organisation issued €1 billion worth of ‘green use-of-proceeds bonds’.

The proceeds from these bonds are being used to refinance Smurfit Kappa’s portfolio of eligible assets: 96% goes towards circular economy adapted products, production technologies and processes, and/or certified eco-efficient products; and 4% towards environmentally sustainable management of living natural resources and land-use. The vast majority of the organisation’s eligible assets comprise productive assets related to reclamation, recycling, paper milling and packaging conversion, which have received the highest level of contribution under the ISS ESG Corporate Rating.

Above: Smurfit Kappa’s Green Bond Portfolio

Collaboration is key

Not only is Smurfit Kappa making strides in green financing, but also in sharing best practice with its peers. Its HYFLEXPOWER project, a renewable energy research project located at its Saillat paper mill in France, is the first in the world to introduce an integrated hydrogen gas turbine demonstrator. This highly innovative project involves significant collaboration across several industries, academic bodies and research institutes including ENGIE Solutions, Siemens Energy, Centrax, Arttic, German Aerospace Center (DLR), and four European universities.

The hydrogen pilot was successfully trialled in September 2022, with a mix of 30% hydrogen and 70% natural gas. The aim of the HYFLEXPOWER project is to clearly demonstrate that renewable energy can be converted to hydrogen and serve as a flexible means of storing energy which can then be used to power an industrial turbine.

|  |  |

An engaged board

The guidance and input of an engaged and proactive board has been critical to the success of Smurfit Kappa’s climate and sustainability journey. The Sustainability Committee was established by the board, with four non-executive directors on the committee who bring a wealth of knowledge and skills from their various backgrounds, including two most recent appointees who come from sustainability-related backgrounds.

The board has been hands-on in its approach to approving projects. In advance of the announcement of a project to invest $100 million in reducing carbon emissions in Colombia, board members had the opportunity, as part of a board visit to Colombia, to understand how the project would work in practice. The boiler, which will be constructed at Smurfit Kappa’s paper mill in Yumbo, will replace existing fossil fuels use with different types of organic waste to generate cleaner energy. It will reduce Smurfit Kappa’s global scope 1 and scope 2 emissions by approximately 6%.

Outcome

By issuing green finance instruments Smurfit Kappa has embedded sustainability into its capital structure whilst simultaneously placing sustainability firmly at the centre of its operating model. This has allowed the organisation to invest in reducing its CO2 emissions in line with the Paris Agreement and reaching at least net zero by 2050. This process has been supported by an experienced and proactive board that has worked closely with the executive team to ensure a joined up approach to the organisation’s climate and sustainability strategy.

All illustrations reproduced from originals provided by Smurfit Kappa. With thanks to Smurfit Kappa for participating in this case study.