Brazilian beauty giant Natura &Co has long been a champion of sustainability. It became the world’s first publicly traded company to receive B Corp certification in 2014 and has an engaged board that sees sustainability as an opportunity rather than a compliance issue.

The company owns multiple cosmetic, fragrance and toiletries brands, and sits alongside other household names such as The Body Shop and Avon as part of the Natura portfolio. It operates on a strategy that companies should be ‘agents of change’ and that a company’s value is connected to its capacity to contribute to society.

What is Natura &Co?

Natura &Co is a Brazilian cosmetics group operating in more than 100 countries, with over 3,700 stores and 35,000 employees. Its brands include Avon, Natura, The Body Shop and Aesop. It is the world’s largest B Corp™.

The Challenge

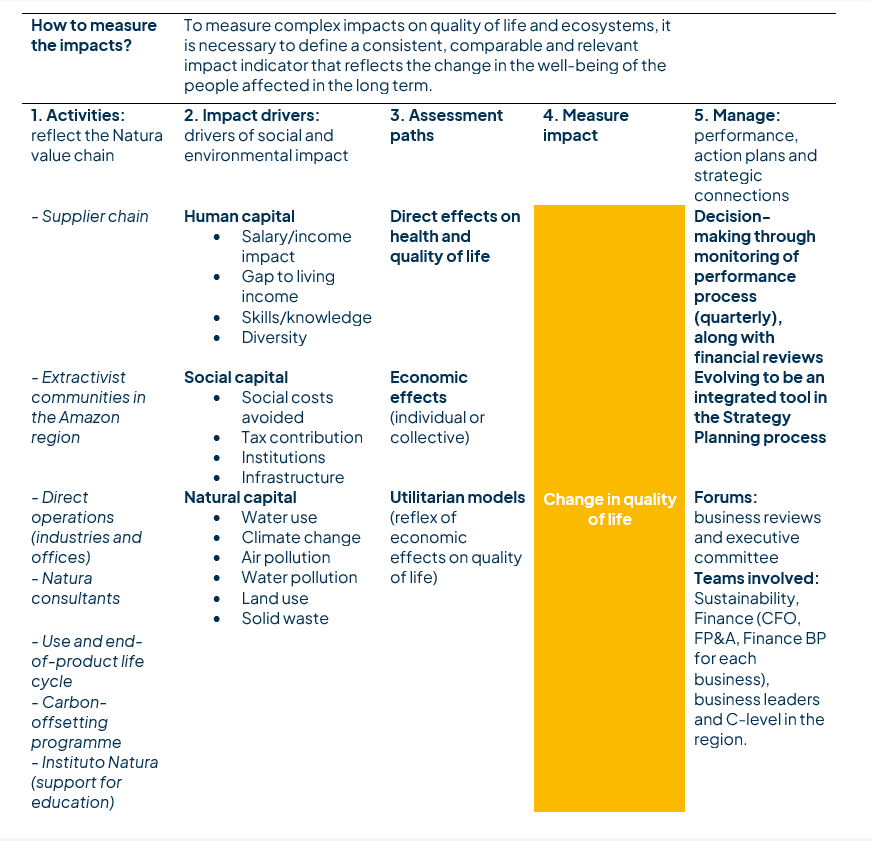

The challenge for Natura is how to measure its value to society. To fully embed sustainability into the company decision-making process, the organisation needed a new form of measurement – one that didn’t just reflect its financials, but that was based on the socio-environmental impact it was having. Natura already had success in using environmental and social profit and loss methods, but needed an approach that fully encompassed the company’s outputs to gain a more comprehensive picture of its impact.

A new financial tool

Natura’s journey to impact reporting started in 2010, when it sought to understand the use of palm oil within its supplier network. It then broadened its scope and started measuring its environmental footprint using Environmental Profit and Loss (EP&L) accounting, which quantified the costs and the environmental benefits of its value chain following standards set by the Natural Capital Protocol (led by the Capitals Coalition) and the World Business Council for Sustainable Development. In 2018, Natura started the development of Social Profit and Loss (SP&L) accounting with consultants and suppliers to calculate its contributions in the human and social spheres.

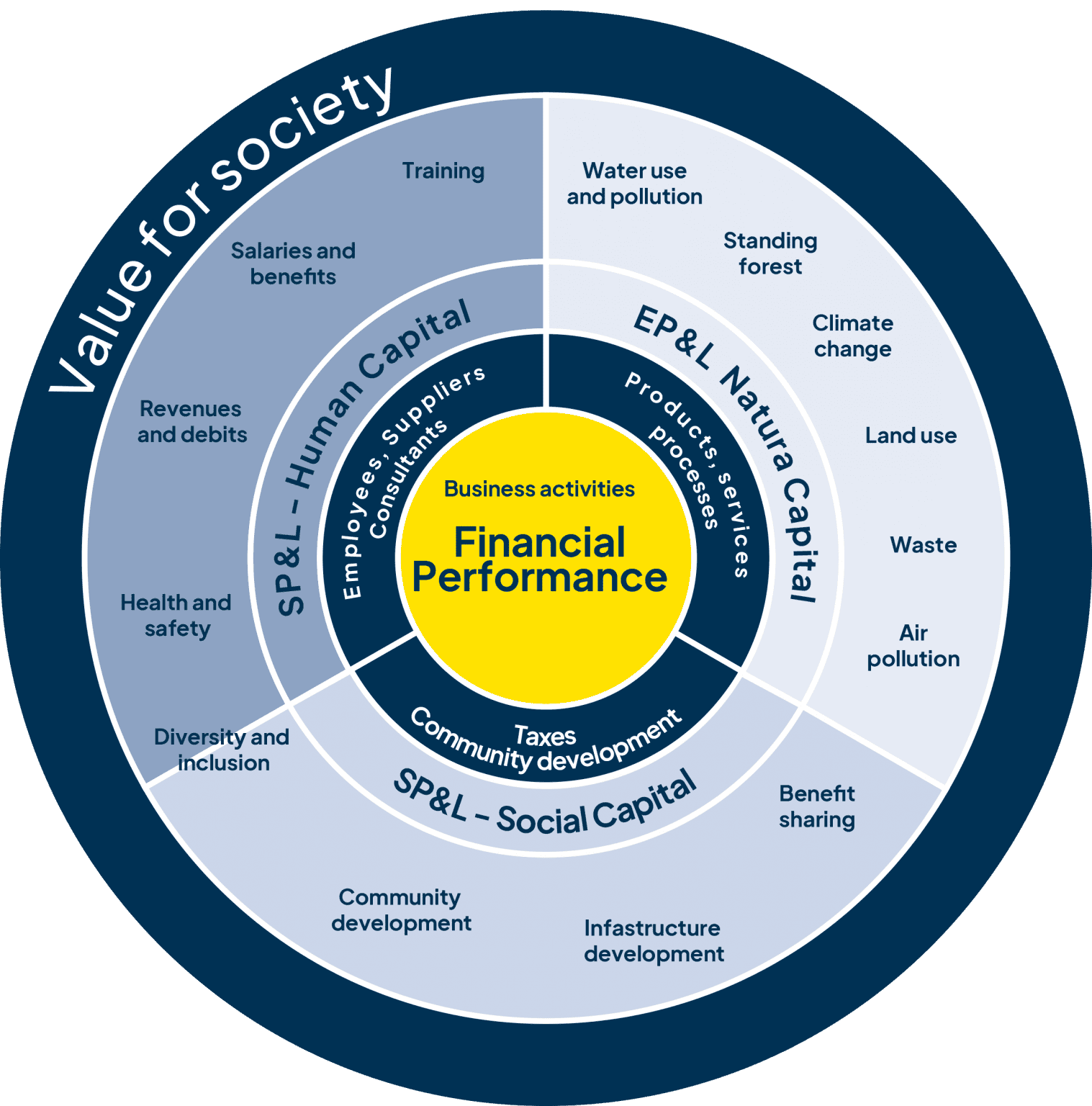

By 2021, Natura had created a new financial tool: Natura’s Integrated Profit and Loss (IP&L) methodology. The IP&L is a pioneering method that collects data, identifies impacts, attributes societal value and, accordingly, enables better business decision-making considering three groups of capital that generate value for society: natural, human and social.

Above: The components of Natura &Co’s Integrated Profit and Loss (IP&L)

The IP&L captures the impacts of Natura’s business activities across its full value chain ranging from its supply chain and extractive communities in the Amazon region, through to operations, beauty consultants, product use and product end-of-life. The results are directly comparable to financial results, which helps in integrated management, risk management, reporting to the board and investors.

The IP&L approach

The IP&L approach captures the total value created by the business for society, including both positive and negative factors. To achieve this, Natura identifies and measures all externalities and multiplies them by valuation factors (derived from accepted standards, protocols and data from multilateral institutions including the Capitals Coalition, World Bank and the World Health Organisation), resulting in social and environmental monetary impacts.

Above: Natura &Co’s impact measurement model

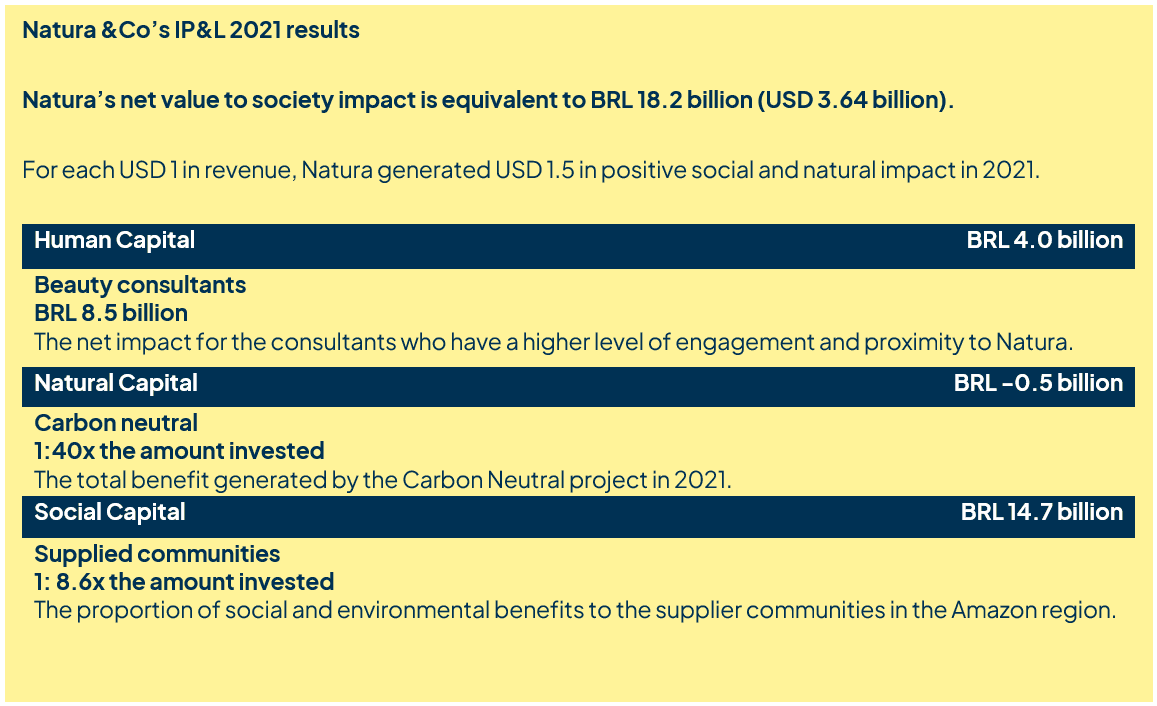

The uniqueness of the IP&L approach is the monetisation of results and its focus on impacts. This is in contrast to usual Key Performance Indicators that focus on activities, outputs or outcomes. In 2021, Natura’s IP&L showed a net-positive societal value of approximately R$18 billion (around US$3.5 billion), mostly driven by social and human capital. For each US$1 in revenue, Natura generated US$1.5 net-positive societal impact.

The overall value of Natura’s natural capital is still negative, as is the case for most companies, mainly due to the final stages of disposal of products by the consumer and subsequent recycling. This underlines why it is so important to have natural capital reflected in the IP&L, so that action can be taken and prioritised.

Above: Natura &Co’s IP&L 2021 results

IP&L in practice

Natura has a strong relationship with extractive communities in the Amazon who supply the organisation with vegetable raw materials. Natura has helped build infrastructure for these cooperatives and contributed towards local development in partnership with local institutions. Using its IP&L methodology, this activity provides a return to society of 8.6 times the amount invested.

A further example is Natura’s Carbon Neutral Program, which has reduced and offset the company’s greenhouse gas emissions since 2007. This program provides a return for society of 40.1 times the amount invested due to the additional co-benefits in human health, ecosystem services and job creation delivered by the offsetting projects.

Circular Carbon project

The IP&L is just one part of Natura’s 2030 Vision, which encompasses a broad plan to tackle some of the most urgent global issues including climate change and deforestation in the Amazon. Among the group’s goals is a target to achieve net zero carbon emissions by 2030, and action to eliminate deforestation in the Amazon by 2025.

Natura has been carbon neutral since 2007. To fight against deforestation and encourage the role of family farmers in conserving the environment, Natura developed its first carbon offset payment project within its production chain, called the Circular Carbon project. This project remunerates the families of small farmers, not only for the purchase of inputs and benefit sharing, but also for the service of environmental conservation. Carbon offsetting within an organisation’s value chain is also referred to as carbon insetting (see our carbon offsetting explainer for further details).

|  |  |

Monitoring of sustainability targets and the role of the board

Natura’s board plays a crucial role in setting bold sustainability targets, and also in ensuring these targets are being met. It takes a long-term approach, with board members seeing their role as forward-thinkers assessing emerging trends and looking for opportunities. Importantly, the board views sustainability results with equal importance to financial results.

To monitor progress against sustainability goals, socio-environmental indicators are included in Natura’s performance management model. Since 2009, these indicators make up part of the variable remuneration of employees. This commitment also influences the remuneration of executives, who have greenhouse gas emissions reduction targets within their goals.

Natura’s finance team plays an important role in measuring impacts, supporting data collection, monitoring progress of socio-environmental issues and combatting climate change via KPIs. This active role played by the finance team has supported the establishment of relevant goals, and encourages the creation of action plans that improve all the company’s results, whether economic, social, human or environmental.

The impact

The use of the IP&L has become a key tool in Natura’s business strategy and a part of its quarterly performance review, which includes board level review. The IP&L approach has been so successful in helping Natura prioritise solutions to manage its impacts, that the organisation is planning to expand the model and make it scalable to cover its other brands in the group.

Natura also wants the IP&L approach to become a global template for others to follow, in the belief that systemic change can only happen if we act together. That’s why Natura is sharing the IP&L methodology with other companies and organisations, so that it can be collectively debated and improved.

The more companies start to attribute value to their impacts and adopt transparency in the disclosure of their results, the greater steps will be made towards ensuring all decisions consider the triple bottom line of people, planet and profit.

All illustrations reproduced from originals provided by Natura &Co. With thanks to Natura &Co for participating in this case study.